About Me

Mortgage Process

Loan Programs

Leather's Team Lending

Better Mortgages. Better Lending.

Get the mortgage you deserve today and make your dream home a reality

Apply Now

Show real estate agents and sellers you are serious about buying by coming prepared with a mortgage pre-approval. It lets your real estate agent know exactly what price range you are eligible to buy your next property. Start the application now

First Time Home Buyer Educational Program

Learn everything you need to know about the home buying process with this free course

What Can You Afford?

Calculate what you can afford with my online mortgage calculator. See a breakdown of your monthly payments with our amortization schedule

What my clients are saying...

Streamline Home Loans (NMLS Lic. #1810048) Is an equal housing lender. This is not a commitment to lend or extend credit. Programs, rates, terms and conditions are subject to change without notice. Terms and conditions apply. All rights reserved. Contact us for details. Consult your accountant about tax deductions. NMLS Consumer Access

Streamline Home Loans

NMLS # 1810048

3030 South Durango Drive,

Las Vegas, NV 89117

Tel: 702-213-4000

About Me

Mortgage Process

Loan Programs

Maggie Leathers

Loan Officer - NMLS# 1797519

Cell: 717-860-0345

maggie.leathers@streamlinehl.com

© Leather's Team Lending. All rights reserved.

Thank you!

Thank You! One of our loan experts will be contacting you shortly

Maggie Leathers- NMLS# 1797519

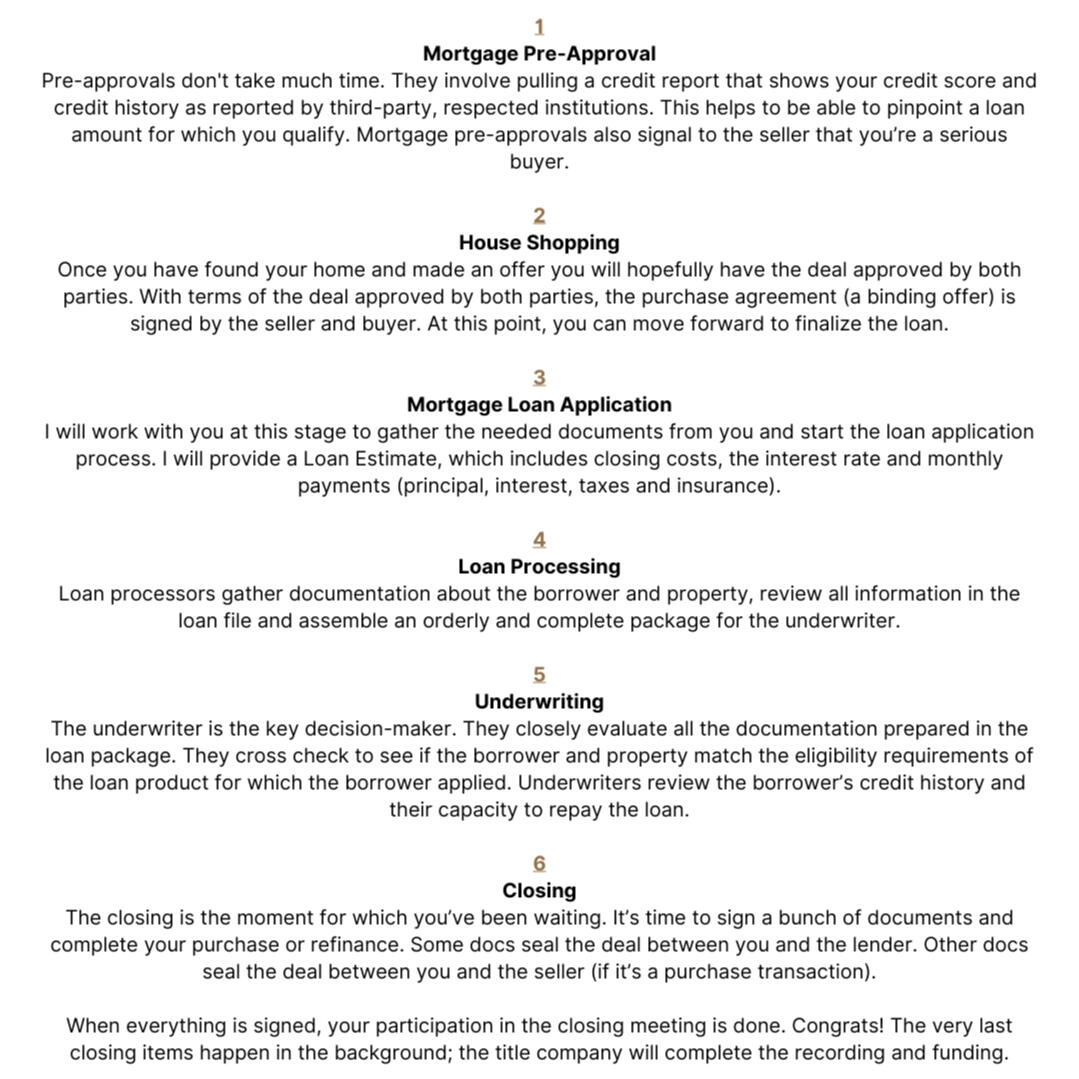

Typical Mortgage Process

The mortgage loan process largely consists of "mortgage paperwork", which is mostly about providing documents needed for a mortgage that show how much you earn, where you've lived, monthly debts and account balances. You can provide much of this information in person or on your application. I will always try to make the loan process as simple as I possibly can. If you have any questions at all, I can help answer them and help you to understand the process in full.

Maggie Leathers- NMLS# 1797519

Conventional Home Mortgage Loans

A conventional mortgage is a mortgage in which the underlying terms and conditions meet the criteria set out by Fannie Mae and Freddie Mac. Approximately half of all mortgages issued are conventional mortgages. Or, to put it another way, Fannie Mae and Freddie Mac guarantee and/or purchase about half of all mortgages.Types of Conventional Mortgages

Conventional loans can be either Fixed or an adjustable rate. Fixed-rate mortgages have a set interest rate for the entire length of the mortgage term which can be between 10 and 30 years. An adjustable-rate mortgage (ARM) has a term of 30 years with a low introductory rate for a fixed period followed by periodic adjustments according to a specific benchmark, typically a specific LIBOR or a T-Bill index.

A non-conforming loan is a home loan that does not conform to the underwriting guidelines set forth by the government-sponsored enterprises Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation).These types of loans are typically offered to borrowers who do not qualify for conforming loans. While its good to have this type of home loan as an option, the downside is non-conforming mortgages typically have higher interest rates and may carry some additional fees and even some additional insurance requirements. In other words, they are typically more costly.

Non-Conforming Home Mortgage Loan Advantages

An option if you are unable to qualify for a conforming mortgage.

Higher loan amounts available in the case of jumbo loans.

Depending on the loan option, you might be able to buy different types of property than you could with a standard conforming loan.

You might be able to get a non-conforming loan if you have a negative mark on your credit like a recent bankruptcy.

Non-Conforming Home Mortgage Loan Disadvantages

A minimum down payment of 20% or more.

Stricter credit-qualifying criteria, with more scrutiny of your credit profile and income.

A higher mortgage interest rate.

Non-conforming Home Mortgage Loans

Conforming Home Mortgage Loans

Conforming loans are mortgages that conform to financing limits set by the Federal Housing Finance Agency (FHFA) and meet underwriting guidelines set by Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Morgage Corporation) which are both government-sponsored enterprises.These underwriting guidelines include caps on the size of the loan, as well as how much a borrower’s debt-to-income ratio can be. Conforming loans usually offer lower interest rates than non-conforming home loan mortgages.

Conforming Home Mortgage Loan Advantages

Often easier to qualify for.

Can have a lower mortgage interest rate.

May offer a lower down payment in some cases.

Can also offer some wiggle room with your credit score in some cases.

What Is Cash-Out Mortgage Refinancing?

A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. The difference between these two loans is provided to the homeowner as cash.A cash-out refinance differs from a traditional mortgage refinancing, which simply replaces your current loan with a new loan that has a new set of terms and in many cases, a lower interest rate.A cash-out refinance also differs from a home equity line of credit (HELOC), which allows you to borrow cash using the home-equity as collateral. HELOCs function as a second mortgage, with the borrower withdrawing and repaying funds on a more flexible schedule, and the government allowing a tax deduction for interest payments. Unlike traditional first or second mortgages, a HELOC interest rate is not fixed; the rate varies from month to month with the prime rate.

Cash-Out Mortgage Refinancing Advantages

Use your home equity to pay for improvements that will increase the property value of your home.

Take advantage of the potential tax-deduction benefit associated with the interest paid on a mortgage loan.

Pay off high-interest and/or high-balance credit cards or eliminate other high interest debts to save money.

Pay for unforeseen expenses, such as emergency medical bills or costly car repairs.

Helping to pay for college tuition.

Cash-Out Mortgage Refinancing Disadvantages

Interest Costs: You’ll restart the clock on all of your housing debt, so you’ll increase your lifetime interest costs (borrowing more also does that).

Foreclosure risk: Because your home is the collateral for any kind of mortgage, you risk losing it if you can’t make the payments.

Closing costs: You’ll pay closing costs for a cash-out refinance, as you would with any refinance. Closing costs are typically 2% to 5% of the mortgage - that’s $4,000 to $10,000 for a $200,000 loan. Make sure your potential savings are worth the cost.

Enabling bad habits: Using a cash-out refinance to pay off your credit cards can backfire if you run up your credit card balances again.

Cash-Out Mortgage Refinancing

Investment Property Loans

Investing in a property is a great way to make passive income or provide a vacation home for your family. I can help make your property investment goals a reality by providing the right financing to get you started.An investment loan is for a single-family, townhome, condo, or multi-unit property that has been purchased with the intention of earning a return on the investment, either through rental income, future resale or both.For those interested in buying an investment property, I offer loans to fit your unique needs.

What is a Fixed-Rate Mortgage Loan?

A fixed-rate mortgage (FRM) is a mortgage loan that has a fixed interest rate for the entire term of the loan. Generally, lenders can offer either fixed, variable or adjustable-rate mortgage loans with fixed-rate monthly installment loans being one of the most popular mortgage product offerings.These mortgages are typically available in 5 year increments between 10 and 30 year terms. The 30-year fixed rate mortgage is the most common type of mortgage people take out.

Fixed-Rate Mortgage Loans Advantages

You will always know exactly how much of a payment is due each month. So if lending rates go up you still pay the lower fixed rate that you are in.

Fixed-Rate Mortgage Loans Disadvantages

If interest rates drop, you still pay the locked-in fixed rate.

Sometimes a fixed rate loan can be harder to obtain from a lender due to higher monthly payments.

Fixed-Rate Mortgage Loan

Rehab and Home Renovation Loans

FHA 203(k) Rehab and Home Renovation Loans

An FHA 203(k) loan is a type of government-insured mortgage that allows the borrower to take out one loan for two purposes – home purchase and home renovation. An FHA 203(k) loan is wrapped around rehabilitation or repairs to a home that will become the mortgagor’s primary residence. An FHA 203(k) is also known as an FHA construction loan.Who Is It For?

The FHA 203(k) loan encourages families in the low- to moderate-income bracket to purchase homes that are in dire need of repairs – especially homes that are situated in old communities. The program allows an individual to buy a home and renovate it under one fixed or adjustable-rate mortgage. The amount that is borrowed includes the purchase price of the home and the cost of renovation, including materials and labor.

FHA Standard 203(k) Home Improvement Advantages

Minimum 3.5% down payment.

Borrow up to 96.5% of projected value after improvements are done.

FHA Standard 203(k) Home Improvement Disadvantages

Mortgage Insurance Premium (MIP) required.

Primary residence, owner-occupied homes only.

A Jumbo loan, also known as a Jumbo Mortgage, is a type of financing that exceeds the limits set by the Federal Housing Finance Agency (FHFA). It is essentially a non-conforming loan that allows a borrower to purchase or refinance a high value property.Unlike conventional mortgages, a Jumbo loan is not eligible to be purchased, guaranteed, or securitized by Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Morgage Corporation). Jumbo mortgage loans are designed to finance luxury properties and homes in highly competitive local real estate markets. Jumbo mortgage loans come with unique underwriting requirements and tax implications.Typically to secure a Jumbo home loan, a borrower must have a high credit score, healthy financial reserves and a 20% down payment.

Jumbo Home Loan Mortgage Advantages

Loan amounts up to $2 million.

Eliminates the need for secondary financing.

Allows buyers to finance more expensive properties in counties with lower conforming loan limits.

No prepayment penalties (even on ARMs).

Jumbo Home Loan Mortgage Disadvantages

You will need a min 20% downpayment.

You have to have a very high credit score to qualify.

You need to have a high net-worth and healthy financial reserves.

Jumbo Loans for Home Mortgages

FHA Home Loans

Federal Housing Administration (FHA) Home Loans

A popular choice for first-time homeowners, FHA loans are a great way to secure financing for borrowers who have less money to put down on a new house and lack the credit history to qualify for a conventional loan.FHA loans are mortgages insured by the Federal Housing Administration. These government loans are popular among homebuyers, especially first time homebuyers, because of their lower down payment requirements and their more flexible lending standards.

FHA Home Loan Advantages

FHA mortgages typically can be obtained with little money down and the down payment may come in the form of a gift from employers, family members, or charitable organizations.

Closing costs are usually lower than a conventional loan.

As FHA mortgages are insured, lenders are generally far more willing to offer loan terms and qualifications that are easier to meet than conventional loans.

FHA Home Loan Disadvantages

You will require a mortgage insurance premium in addition to your monthly payments. Mortgage insurance is implemented to help lenders protect their interest when allowing borrowers to secure a loan with little cash for a down payment.

USDA Rural Development Home Loans

Guaranteed by the United States Department of Agriculture (USDA), these loans offer an affordable way to purchase property in rural neighborhoods. These are non-urban areas, but often include villages or small towns near bigger cities. The loan term is a 30-year fixed-rate mortgage.The USDA loan’s purpose is to provide low to moderate income households the opportunity to achieve the dream of homeownership in eligible rural areas. They help to do so by guaranteeing each USDA loan against default. This guarantee allows for some great benefits such as zero down payment, low rates and lenient credit requirements.

USDA Rural Development Home Loan Advantages

No down payment.

Allows for non-traditional credit.

Lower closing costs, with no limit on contributions from seller or gift money.

USDA Rural Development Home Loan Disadvantages

Must meet USDA location standards.

USDA Guarantee Fee is required.

USDA Home Loans

VA Home Loans

A VA loan is a mortgage loan available through a program established by the United States Department of Veterans Affairs. VA loans assist service members, veterans, and eligible surviving spouses to become homeowners. The VA sets the qualifying standards, dictates the terms of the mortgages offered and guarantees a portion of the loan. VA home loans are provided by private lenders, such as banks and mortgage companies.

VA Home Loan Advantages

Easier requirements for income and credit score.

No down payment.

Lower closing costs.

Interest rates may be negotiable.

VA Home Loan Disadvantages

Must be an eligible veteran or unmarried surviving spouse of a veteran who died on active duty or as the result of a service-connected disability.

VA Funding Fee may be required.

About Me

Working for you & NOT the Banks!Markets Served: NV, CA, AZ, TX, and FL*Ask about out of state investment purpose loan programsWith experience in both the service industry and sales, we understand that the mortgage business is always going to be unique; especially in Las Vegas. Whether you're a first-time buyer, a multi-unit investor, or simply in search of the perfect refinance; we're here to help. Because we're a broker, we'll research your unique situation with 14 different partner lenders to identify the perfect loan for you!Before making offers we'll help review your budget, assets, and calculate your income to get a clear picture of what type and amount of loan will work best for you. If you've been turned down with a traditional bank in the past, please reach out to us! We specialize in saving deals and are happy to help coach you if there are any steps you'll need to take prior to approval.Although the financial aspect of purchasing property can be stressful, it doesn't have to be with the right lending team in your corner. Give us a call today and make your home ownership and home investment dreams come true.